Right now, sales total 548,370 K and income totals -288,430 K. Market capitalization of the company is 4.11 billion based on 148,910K outstanding shares. Should the price break the second support level, the third support level stands at $15.63. If the price goes on to break the first support level at $17.26, it is likely to go to the next support level at $16.64. The third major resistance level sits at $20.52. However, in the short run, Lightspeed Commerce Inc.’s stock first resistance to watch stands at $18.89. Based on volatility metrics of the stock, it showed a historical volatility of 81.21% in the past 14 days, which was lower than the 82.65% volatility it showed in the past 100 days.Īt the time of writing, stock’s 50-day Moving Average is $19.81, while its 200-day Moving Average is $24.83. Montreal-based Lightspeed is a payment processing firm that helps companies handle in-person.

Wall Street market experts anticipate that the next fiscal year will bring earnings of -0.07 per share during the current fiscal year.ĭuring the past 100 days, Lightspeed Commerce Inc.’s (LSPD) raw stochastic average was set at 14.03%, which indicates a significant decrease from 41.50% during the past two weeks. Spruce Point Management alleges tech company has exaggerated its finances, prompting 11 stock plunge. This company achieved a net margin of -52.60 while generating a return on equity of -10.83. (LSPD) Earnings and ForecastsĪs on, Multinational firm has announced its last quarter scores, in which it reported -$0.15 earnings per share (EPS) for the period topping the consensus outlook (set at -$0.19) by $0.04. is 10.01%, while institutional ownership is 59.73%. The insider ownership of Lightspeed Commerce Inc.

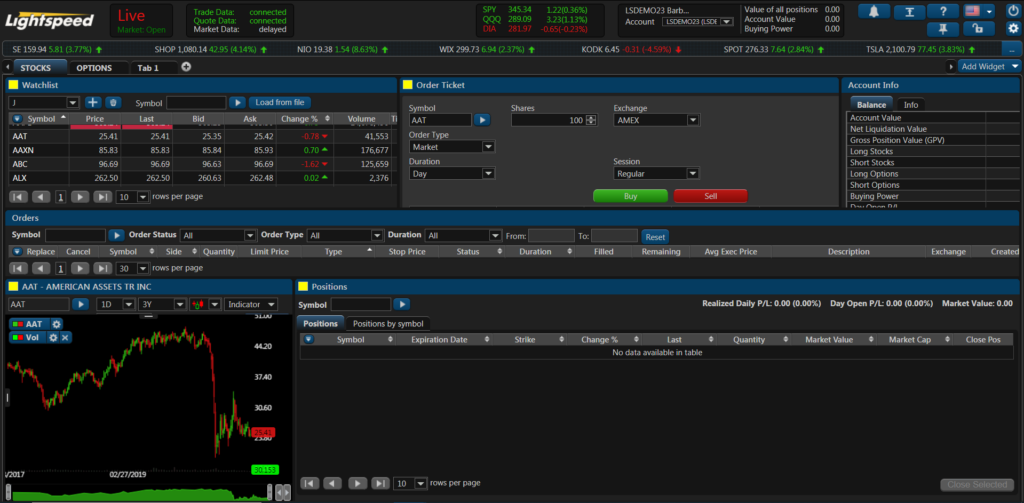

#Lightspeed stock price software

Observing investor behavior towards Software – Application industry stocks is more important than anything else. As of 2022 October 10, Monday current price of LSPD stock is 24.550 and our data indicates that the asset price has been in a downtrend for the past 1 year (or since its inception). In terms of profitability, gross margin is +30.18, operating margin of -49.45, and the pretax margin is -57.51. Let’s determine the extent of company efficiency that accounts for 3000 employees. Lightspeed Commerce stock price target cut to 75 from 100 at Truist. With a float of $135.13 million, this company’s outstanding shares have now reached $148.97 million. View Lightspeed Commerce Inc LSPD investment & stock information. Lightspeed Commerce stock price target cut to 45 from 60 at Truist. The company achieved an average annual earnings per share of -72.50%. Lightspeed Commerce stock price target cut to 45 from 60 at Truist May. For example, the Standard plan ends up costing 119 per month if you choose the annual plan versus.

#Lightspeed stock price free

Sign up here to get your free report now.ĭuring the last 5-year period, the sales growth of Technology Sector giant was 66.70%. Monthly subscriptions to Lightspeed Retail are less expensive if you pay annually versus monthly. In fact, within our report, "Top 5 Cheap Stock to Own Right Now", we have identified five stocks we believe could appreciate the most even if you just have $1,000 to invest. In February, the company announced that Dasilva was stepping down as CEO, a natural leadership transition that nonetheless created additional uncertainty.While finding safe stocks with the potential for monster gains isn't always easy, we've found a few that could pay out well. 120.30 AMZN0.54 Apple Inc 145.43 AAPL0. Lightspeed also has had to contend with allegations from short-seller Spruce Point Capital Management LLC that it was inflating many of its performance metrics, a charge the company said was false. Lightspeed POS Inc traded at 24.49 this Friday October 7th, decreasing 2.59 or 9.56 percent since the previous trading session. Even after this week’s pop, Lightspeed’s shares were still down about 40 per cent from the start of the year, as investors have generally soured on growth stocks amid worries about runaway prices and the lengths to which central banks might go to get inflation under control. That excitement has been replaced by trepidation over the acceleration of global inflation.

0 kommentar(er)

0 kommentar(er)